Table of Contents

Introduction

Student loan debt can feel like a heavy burden, especially if you’re working hard in a public service job. But there’s good news! The U.S. government has a program called Public Service Loan Forgiveness pslf help tool . If you work in public service and meet certain requirements, you could have your federal student loans forgiven.

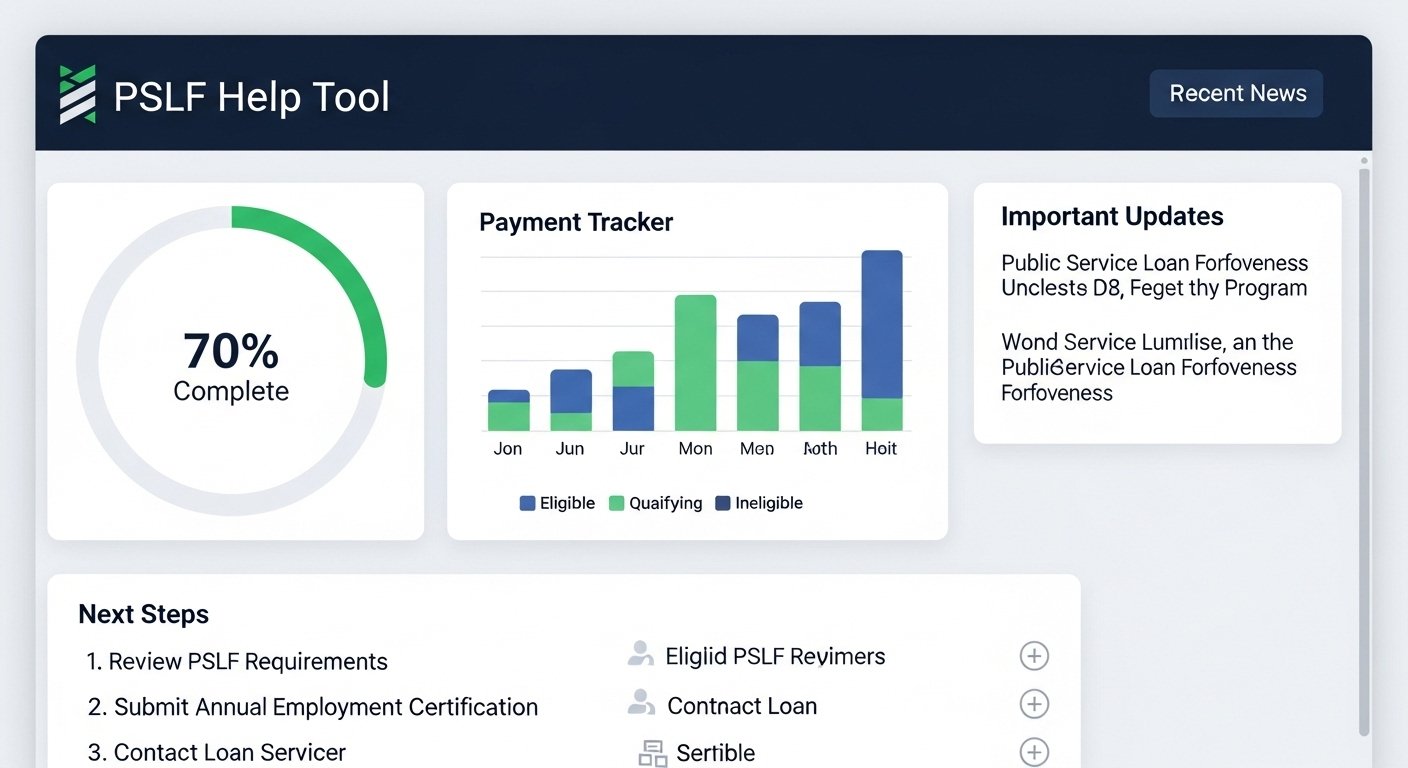

Sounds great, right? It is—but the process can feel confusing. That’s where the PSLF Help Tool comes in.

The PSLF Help Tool was created just for you by the U.S. Department of Education. It helps public service workers understand the PSLF program, check if they qualify, and submit all the right forms—step by step. It turns a complex system into a much easier one.

In this guide, you’ll learn how the PSLF Help Tool works, who should use it, what to expect, and how it can help you get closer to student loan forgiveness. Let’s make it simple, clear, and helpful.

What Is Public Service Loan Forgiveness (PSLF)?

Before we explore the tool, let’s quickly cover what Public Service Loan Forgiveness (PSLF) means.

PSLF is a federal loan forgiveness program for people who work in public service. This includes teachers, nurses, government workers, nonprofit employees, and more. If you work full-time for a qualifying employer and make 120 monthly loan payments under a qualifying repayment plan, the remaining balance on your Direct Loans may be forgiven.

That can mean getting tens of thousands of dollars wiped away—with no tax bill at the end.

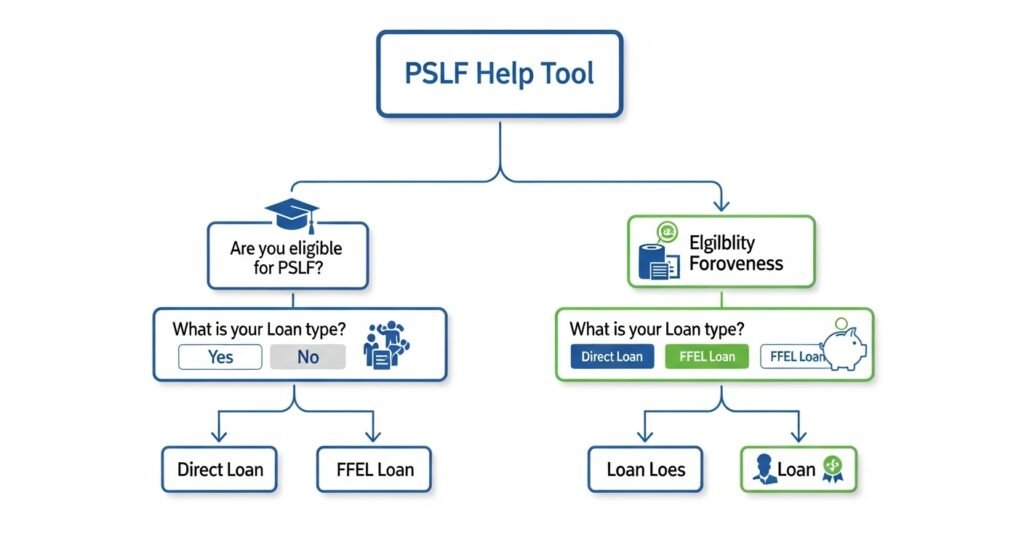

But to benefit, you must follow the steps exactly. You need the right kind of job, loans, and repayment plan. That’s where the PSLF Help Tool can save you time, stress, and mistakes.

What Is the PSLF Help Tool?

The PSLF Help Tool is an online tool on the official StudentAid.gov website. It helps student loan borrowers complete and submit the necessary forms for Public Service Loan Forgiveness.

Here’s what it does:

- Helps you check if your employer qualifies

- Guides you through the PSLF form process

- Reviews your loan types and payment plan

- Sends your form to the correct loan servicer

It’s secure, easy to use, and best of all—it’s free. Instead of hiring someone to help you, the PSLF Help Tool walks you through everything step by step.

If you’re unsure about forgiveness, this tool is a great place to start.

Who Should Use the PSLF Help Tool?

Not sure if this tool is for you? You should consider using the PSLF Help Tool if:

- You work for a government or nonprofit employer

- You have federal Direct Loans or want to check your loan type

- You’ve made payments under an income-driven repayment plan

- You want to see how close you are to achieving loan forgiveness

- You plan to apply for PSLF or need to certify previous employment

Even if you’re not totally sure you qualify, the tool can help you figure that out. It will tell you what steps to take to become eligible—like consolidating your loans or switching repayment plans.

Where to Find the PSLF Help Tool

Finding this helpful tool is easy. Just follow these steps:

- Go to https://studentaid.gov/pslf

- Click on “Start the PSLF Help Tool”

- Log in with your FSA ID (the username and password you used for FAFSA)

From there, you’ll enter details about your employer, confirm your loans, and download the PSLF form. You can print and sign it or use the electronic signature option if your employer agrees.

It’s laid out clearly and made to walk you through every section. You don’t need to be a lawyer or loan expert. Just follow the prompts.

Step-by-Step: How to Use the PSLF Help Tool

Let’s go through each part of the PSLF Help Tool in plain, easy steps:

Step 1: Log in with your FSA ID

This is your personal login for the StudentAid.gov website.

Step 2: Enter your employer’s information

Use your W-2 or ask your HR department for the employer’s EIN (Employer Identification Number).

Step 3: Confirm your job hours and dates

Make sure you worked full-time (at least 30 hours/week or what your employer considers full-time).

Step 4: Review your loan details

The tool checks if your loans are Direct Loans and if you’ve made qualifying payments.

Step 5: Generate your form

The system fills in your details and creates your PSLF Employment Certification Form.

Step 6: Sign and submit

You can sign digitally or print the form and bring it to your employer for their signature. Then it goes to MOHELA, the loan servicer for PSLF.

Now your progress is officially tracked!

Why Certify Employment Annually with PSLF?

Even if you’ve been working in public service for years, it’s smart to certify your employment every year through the PSLF Help Tool.

Here’s why annual certification helps:

- Keeps a record of your qualifying payments

- Makes applying for forgiveness easier later

- Confirms your employer still qualifies

- Updates your official payment count

- Prevents surprises when it’s time to apply

Think of it like checking your credit report—it keeps your PSLF file accurate and moving forward. Every time you switch jobs or hit a new year, go ahead and use the tool again.

Understanding MOHELA and PSLF Tracking

Once you submit your form through the PSLF Help Tool, it goes to MOHELA, the loan servicer that manages all PSLF files.

Here’s what MOHELA does:

- Reviews your form

- Tracks your qualifying payments

- Updates your account dashboard

- Approves forgiveness once 120 payments are reached

If your loans aren’t already with MOHELA, they’ll transfer after your first PSLF form is processed. Don’t worry—your loan terms won’t change. MOHELA just manages the PSLF progress going forward.

You can log into your MOHELA account to see your up-to-date payment count anytime.

Common PSLF Mistakes the Help Tool Can Prevent

Many people miss out on forgiveness for simple mistakes. That’s why the PSLF Help Tool is so valuable—it points out common problems and helps you fix them.

Here are mistakes the tool helps you avoid:

- Working for a non-qualifying employer without knowing

- Having the wrong type of loan (not a Direct Loan)

- Being on the wrong repayment plan

- Failing to certify past jobs

- Missing employer signatures or details

Thanks to the tool, you’ll know where you stand and what you need to change before applying. This can save you years of confusion and delay.

How the PSLF Help Tool Supports IDR Adjustments

The Income-Driven Repayment (IDR) account adjustment allows borrowers to count more payments toward forgiveness, even if they weren’t originally PSLF-qualifying.

The PSLF Help Tool is a key part of this process.

Why? Because it lets you:

- Certify older employment you forgot

- Add previous public jobs to your count

- See which loans qualify after consolidation

- Avoid missing out on the one-time IDR forgiveness boost

Make sure you complete your PSLF form using the tool so MOHELA can count everything they should!

Is the PSLF Help Tool Easy to Use?

Yes, the PSLF Help Tool is made for regular people—not legal experts or financial pros. It uses simple questions, helpful tips, and auto-filled forms to do most of the hard work for you.

Here’s what borrowers love about it:

- Available 24/7 online

- Saves progress if you stop and return later

- Auto-fills employer info using EIN

- Tells you if your employer qualifies

- Keeps a permanent copy of your submission

You don’t need fancy software or training—the webpage is all you need. Just be ready with your employer info and log in to get started.

Who Should Not Use the PSLF Help Tool?

While the tool works for most public service borrowers, it may not be ideal for:

- Borrowers with only Parent PLUS Loans

- People still on the wrong repayment plan

- Those with no public service work

- Anyone unsure how to create an FSA ID or log in

In these cases, talk to your loan servicer first or call the Federal Student Aid hotline for help. If you’re ready to qualify, the tool will guide you well.

What Happens After You Submit Your Form?

After submitting through the PSLF Help Tool, here’s what happens next:

- MOHELA reviews your employer’s eligibility

- They check your loan and payment history

- You get a letter or email showing how many qualifying payments you’ve made

- If more info is needed, they’ll contact you

- If you’ve made all 120 payments, you’re forgiven!

This tracking happens behind the scenes, but you should keep copies of everything in case something is missed. Monitor your loan status every few months, just to be safe.

PSLF Success Stories

People are getting real results from the PSLF program—and many used the PSLF Help Tool to make it happen.

Jamal, a public school teacher in Georgia, used the tool every year while making IDR plan payments. After 10 years, he had the rest of his $43,000 loan balance wiped.

Maria, a nonprofit caseworker, learned she was on the wrong plan. The PSLF Help Tool showed her how to switch. After fixing it, she got credit for 9 years of payments!

Chris, a veteran turned city employee, used the tool when the IDR adjustment was announced. He got credit for old payments going back 15 years.

These stories remind us that the tool works—but only if you take action.

FAQs

1. Is the PSLF Help Tool free to use?

Yes! It’s 100% free and found on the official StudentAid.gov website.

2. Will the tool tell me if my employer qualifies?

Yes. Once you enter your employer’s EIN, the tool checks and tells you right away.

3. Can I submit the PSLF form online using the tool?

Yes, some employers allow e-signatures. Others require a printed and signed version.

4. How often should I use the PSLF Help Tool?

Use it at least once per year or whenever you change jobs.

5. What if I don’t have an FSA ID?

Go to Studentaid.gov and click “Create Account.” It only takes a few minutes.

6. Can I fix mistakes from the past with the tool?

Yes. You can add previous qualifying jobs and update older PSLF history.

Conclusion

If you’re working in public service and hoping for student loan forgiveness, don’t wait. The PSLF Help Tool is your friendly assistant for getting on the right track. It’s fast, simple, and free—and it can save you years of confusion and delay.

Whether you’re just starting your career or almost at the 120-payment mark, this tool helps you stay organized and confident. It takes the guesswork out of a system that’s known to be tricky.

Visit StudentAid.gov today and let the PSLF Help Tool guide your path to a debt-free future. You’ve already done the service—now it’s time to get the savings.